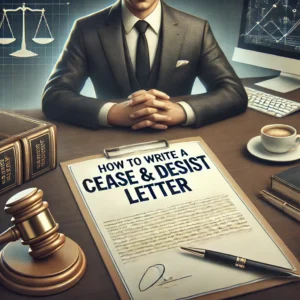

How to Respond to Debt Collector Text Messages and Emails

Learn how to effectively respond to debt collectors contacting you via text messages and emails. This guide helps you understand your rights under the Fair Debt Collection Practices Act (FDCPA), offering strategies to stop unwanted communications, dispute debts, and protect yourself from one-sided communication practices like those highlighted in Hyslip’s Candlestick Theory.