Enough is enough. If you're tired of the constant ringing, the aggressive letters, and the stress of dealing with debt collectors, you have a powerful legal tool: the cease and desist letter for debt collection. Under the FDCPA, you have the absolute right to tell a third-party debt collector to stop contacting you. Once they receive your written request, they are legally required to stop their calls and letters.

This guide gives you a free template, step-by-step instructions, and everything you need to know before you send it. If you're unsure whether a collector's behavior crosses the line, start by learning about your rights against debt collector harassment.

In This Guide

- What Is a Cease and Desist Letter for Debt Collection?

- When Should You Send a Cease and Desist Letter to a Debt Collector?

- How to Send a Cease and Desist Letter: Step-by-Step

- Free Cease and Desist Letter Template for Debt Collection

- What Happens After You Send the Letter?

- Risks and Consequences: What You Should Know Before Sending

- Frequently Asked Questions About Cease and Desist Letters for Debt Collection

What Is a Cease and Desist Letter for Debt Collection?

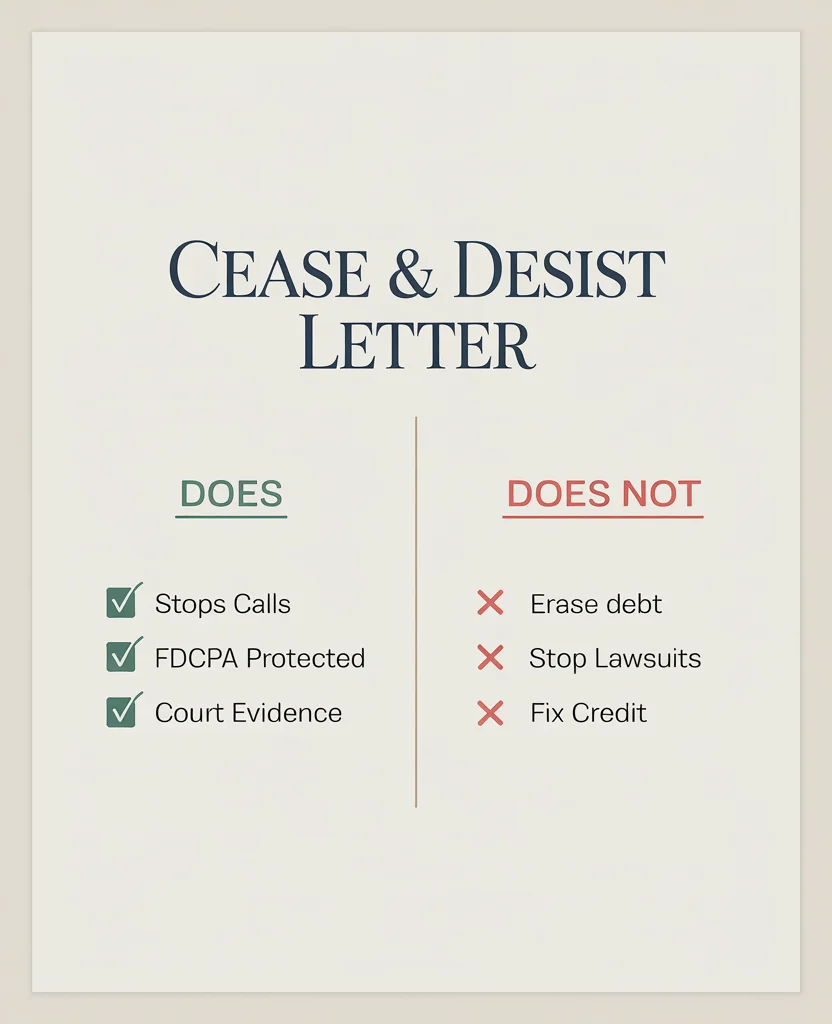

A cease and desist letter for debt collection is a formal written notice you send to a third-party debt collector demanding they stop all communication with you — phone calls, letters, emails, and text messages. It is not a court order. It is a consumer right exercised in writing.

This right is specifically granted under Section 805(c) of the Fair Debt Collection Practices Act (FDCPA), codified at 15 U.S.C. § 1692c(c). Once the collector receives your letter, they are legally required to cease contact, with only two narrow exceptions: they can notify you that they are ending collection efforts, or they can inform you of a specific legal action they intend to take, such as filing a lawsuit.

There is a critical limitation. The FDCPA's cease and desist right applies only to third-party debt collectors — companies that buy debts or are hired to collect on behalf of another entity. It does not apply to original creditors like your bank, hospital, or credit card company contacting you directly about your own account. If the entity contacting you is the original creditor, the FDCPA's communication restrictions do not apply, though state consumer protection laws may still offer protections.

Sending this letter does not eliminate, reduce, or forgive the debt. It only stops the communication. The debt remains on your record, and the collector retains other legal options, including the right to file a lawsuit.

When debt collector harassment becomes unbearable, this letter is often your first line of defense — a direct, legally backed way to take back control of your phone, your mailbox, and your peace of mind.

When Should You Send a Cease and Desist Letter to a Debt Collector?

Not every situation calls for a cease and desist letter. Here's when it makes sense — and when you should consider other options first.

Excessive or illegal calling patterns. If a collector is calling you multiple times a day, calling before 8:00 AM or after 9:00 PM in your local time zone, or contacting you through texts and emails you don't want, a cease and desist letter puts a legal stop to it. Under Regulation F, a collector is presumed to be harassing you if they call more than seven times within a seven-day period regarding a specific debt.

After you've already disputed the debt. If you've sent a debt validation letter and the collector continues contacting you without providing verification, a cease and desist letter is the logical next step.

Time-barred debts. When the debt is past the statute of limitations in your state, collectors may still try to contact you to pressure you into paying or to restart the clock on the debt. A cease and desist letter stops these revival attempts.

Consider alternatives first. Before sending a cease and desist letter, consider whether a debt validation letter — requesting proof you owe the debt under 15 U.S.C. § 1692g — might be a more strategic first move, especially if you're unsure whether the debt is legitimate. Your first step should be to identify whether the collector is a third-party agency or the original creditor.

When a cease and desist is NOT enough. If you are already being sued or have been served with a court summons, a cease and desist letter alone will not protect you. You need legal representation. Be aware that some collectors send fake attorney letters designed to intimidate you — learn how to spot them. Consult an FDCPA attorney immediately.

How to Send a Cease and Desist Letter: Step-by-Step

Follow these five steps to send a legally effective cease and desist letter.

Step 1: Gather the collector's information. Locate the debt collector's full legal name, mailing address, and your account or reference number. You can find this on any letters they've sent you, voicemail transcripts, or caller ID records. If you don't have this information, you can request it by asking the collector during their next call — you are entitled to it under the FDCPA.

Step 2: Fill out the cease and desist template. Copy the free cease and desist letter template below. Fill in every bracketed field with your information and the collector's details. Do not admit to owing the debt. Use neutral language like "the debt referenced above" rather than "my debt" or "the money I owe."

Step 3: Print, sign, and copy. Print the completed letter. Sign it by hand. Make at least one photocopy of the signed letter for your personal records. You will need this copy if you ever need to prove what you sent.

Step 4: Send via USPS Certified Mail with Return Receipt Requested. Take the letter to your local post office and request Certified Mail with Return Receipt Requested (also called the "Green Card"). As of 2026, the total cost is approximately $10.50 at the post office ($0.78 first-class postage + $5.30 certified mail fee + $4.40 return receipt). You can reduce the cost to roughly $7–9 by using online services like usps.com. The return receipt is a postcard signed by the recipient — this is your proof of delivery and your most important piece of evidence if the collector violates your rights after receiving the letter.

Step 5: Store your evidence. Keep the following items together in a safe place: (1) your copy of the signed letter, (2) the USPS certified mail receipt, and (3) the green return receipt card once it arrives. These three documents are your evidence package. If the collector contacts you again after receiving the letter, this documentation becomes the foundation of a federal lawsuit.

Free Cease and Desist Letter Template for Debt Collection

Copy and customize the template below. Replace all bracketed fields with your information.

[Your Full Name] [Your Street Address] [City, State, ZIP Code]

Date: [Month Day, Year]

[Debt Collector's Name] [Debt Collector's Street Address] [City, State, ZIP Code]

Re: [Account Number or Reference Number]

To Whom It May Concern:

Pursuant to my rights under the Fair Debt Collection Practices Act (FDCPA), 15 U.S.C. § 1692c(c), I am writing to formally demand that you cease all further communication with me regarding the above-referenced account.

This letter serves as my written notification that I do not wish to be contacted by your company — by phone, mail, email, text message, or any other means — regarding this matter or any other debts you claim I owe.

Under the FDCPA, you are permitted to contact me only to:

- Advise me that your collection efforts are being terminated; or

- Notify me that you or the creditor intend to invoke a specified legal remedy.

Any further contact beyond these two exceptions will be considered a violation of the FDCPA. I will not hesitate to pursue all legal remedies available to me, including statutory damages of up to $1,000, actual damages, and attorney's fees as provided by 15 U.S.C. § 1692k.

Please govern yourself accordingly.

Sincerely,

[Your Handwritten Signature] [Your Printed Name]

Important: Send this letter via USPS Certified Mail with Return Receipt Requested. Keep a copy for your records.

This template is provided as a general guide. It may not be suitable for every situation. If you are unsure whether to send a cease and desist letter, or if you are facing a lawsuit, contact an attorney.

If a debt collector violates your cease and desist letter, you may be entitled to statutory damages, attorney fees, and actual damages. Learn how an FDCPA attorney can pursue legal remedies on your behalf — often at no cost to you.

What Happens After You Send the Letter?

Once the debt collector receives your cease and desist letter, they can contact you only one more time — and only to tell you one of two things:

- They are ceasing all collection efforts.

- They intend to take a specific legal action, such as filing a lawsuit.

That's it. If they contact you again to demand payment, negotiate, threaten you, or discuss the debt without specifying a legal action, they have violated the FDCPA. Document the contact immediately — save voicemails, take screenshots of texts, and note the date, time, and content of any calls.

You can file a complaint with the Consumer Financial Protection Bureau (CFPB) at consumerfinance.gov/complaint or the Federal Trade Commission (FTC) at reportfraud.ftc.gov. Both agencies enforce the FDCPA. Filing a complaint creates an official record that strengthens any future legal action.

Risks and Consequences: What You Should Know Before Sending

A cease and desist letter is a powerful tool, but it's important to make an informed decision. Here are the potential consequences.

The debt does not disappear. Sending a cease and desist letter stops communication — it does not eliminate, settle, or reduce the debt. The collector or the original creditor can still pursue legal action, including filing a lawsuit against you.

Credit reporting continues. The debt may still be reported to the three major credit bureaus — Equifax, Experian, and TransUnion — even after the collector receives your letter. A cease and desist does not require them to remove the account from your credit report. If you believe information on your credit report is inaccurate, learn about your rights under the FCRA.

The debt may be sold to another collector. The collector may sell or transfer the debt to a different collection agency. The new agency is not bound by your previous cease and desist letter — they can contact you until they also receive one. You may need to send a new letter to each subsequent collector.

You lose negotiation leverage. Once you cut off communication, you lose the opportunity to negotiate a settlement, payment plan, or pay-for-delete arrangement. If you're considering negotiation, do so before sending the letter.

Weigh your options. In some cases, sending a debt validation letter (requesting proof of the debt under 15 U.S.C. § 1692g) or consulting an attorney may be a stronger first move than cutting off all communication.

Frequently Asked Questions About Cease and Desist Letters for Debt Collection

Can I send a cease and desist letter via email?

Yes, you can send a cease and desist letter via email, but it is not recommended as your only method. Certified mail with return receipt provides documented proof of delivery — a signed green card — which is critical evidence if you need to prove the collector received your letter in court. If you send via email, also send a hard copy via certified mail.

Does a cease and desist letter stop a lawsuit?

No. A cease and desist letter stops communication, not legal action. The debt collector retains the full right to file a lawsuit against you to collect the debt. If you've been served with a summons or complaint, consult an FDCPA attorney immediately.

Can I send a cease and desist letter to the original creditor?

No. The FDCPA's cease and desist provision (Section 805(c)) applies only to third-party debt collectors — not to original creditors like your bank, hospital, or credit card company. Original creditors are not covered by the FDCPA's communication restrictions. Some state consumer protection laws may offer additional protections that apply to original creditors.

How long does a cease and desist letter take to work?

The collector must stop contacting you after they receive your letter. With USPS Certified Mail, delivery typically takes 3–7 business days. Once they sign for the letter, they are legally bound to stop — with the exception of the one permitted final notice.

What if the debt collector ignores my cease and desist letter?

If a collector continues to contact you after receiving your cease and desist letter, they are violating the FDCPA. You may be entitled to up to $1,000 in statutory damages per lawsuit, plus actual damages and attorney fees. Contact an FDCPA attorney to pursue legal remedies. You can also file complaints with the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC).

Can I send a cease and desist for a debt I actually owe?

Yes. You have the right to request that a third-party debt collector stop contacting you regardless of whether the debt is valid. The FDCPA does not require you to dispute or deny the debt to exercise your right to cease communication. However, the debt itself does not go away — the collector can still report it to credit bureaus or pursue legal action.

This information is for educational purposes only and does not constitute legal advice. Sending a cease and desist letter may have legal consequences. Every situation is different. Consult with a qualified attorney before taking action. Hyslip Legal offers free consultations for potential FDCPA cases. Contact Hyslip Legal for a free consultation to discuss your specific circumstances.

Last Updated: February 2026