In a court of law, it's not about what you know—it's about what you can prove. When a debt collector violates your rights, the difference between winning a settlement and having your case dismissed often comes down to one thing: Record Keeping.

Under the Fair Debt Collection Practices Act (FDCPA) and Regulation F, debt collectors are required to retain their records for three years. However, rely on their records at your own peril. Documents get "lost," recordings get "deleted," and systems "glitch."

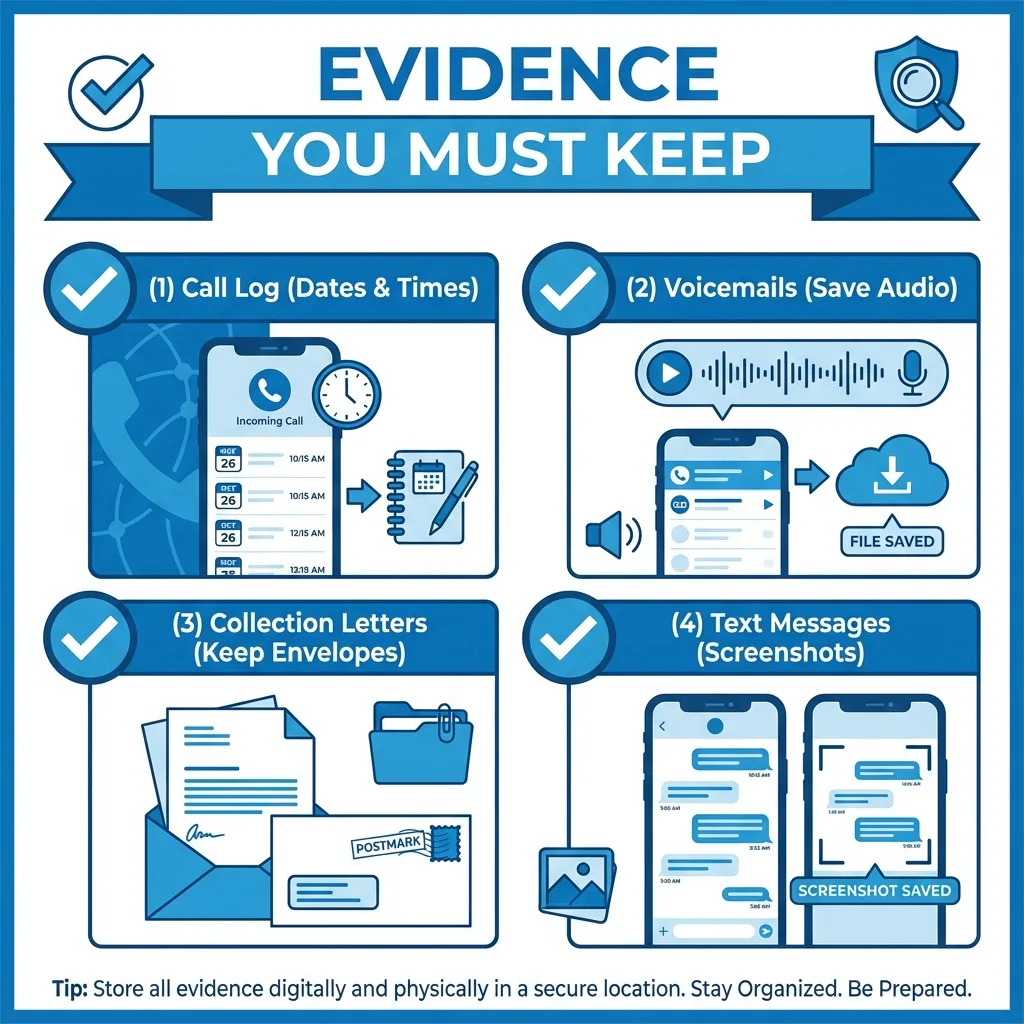

You must keep your own evidence. This guide breaks down exactly what you need to save to build a bulletproof case.

The Consumer Evidence Checklist

1. The Call Log

You cannot rely on your memory. Create a simple log (or spreadsheet) for every single contact.

- Date & Time: Exact timestamp.

- Number: The number on caller ID.

- Duration: How long did it last?

- Who: Name of the agent.

- What: Brief summary ("Threatened to sue," "Called me at work").

2. Audio Recordings

Crucial: Check your state's "One Party Consent" laws before recording a live call. However, you can ALWAYS save voicemails.

Tip: Don't just leave voicemails on your phone. Email the audio file to yourself so you have a permanent backup.

3. Physical Mail

Never throw away a collection letter. Not even the envelope.

- Save the Envelope: The postmark date proves when they sent it (important for the 5-day debt validation rule).

- Scan It: Use a scanning app to create a digital PDF copy immediately.

4. Digital Communications

Collectors allow solicitations via text and email now, but rules still apply.

- Screenshots: Take screenshots of text messages immediately.

- Emails: \"Print to PDF\" to save a permanent offline copy of any email thread.

How Long Should You Keep This?

The Golden Rule: Keep everything for at least three years from the date of the last contact.

Why? The Statute of Limitations for filing an FDCPA lawsuit is generally one year. However, Regulation F requires collectors to keep their own records for three years. By keeping yours for the same duration, you ensure you are protected if old zombie debts resurface.