If debt collectors are harassing you with constant calls, threats, or misleading statements, you have legal protections under the Fair Debt Collection Practices Act (FDCPA). But navigating these laws alone can be overwhelming. That's where an experienced FDCPA attorney comes in.

This guide will help you find the right legal representation to protect your rights and hold abusive debt collectors accountable.

What Does an FDCPA Attorney Actually Do?

An FDCPA attorney specializes in protecting consumers from illegal debt collection practices. Here's what they can do for you:

📋 Case Evaluation

Review your situation, communications, and documents to identify FDCPA violations.

🛡️ Stop the Harassment

Send cease communications letters and ensure collectors follow the law.

⚖️ Legal Action

File lawsuits against violators and pursue statutory damages up to $1,000 per violation.

💰 Recover Damages

Seek compensation for emotional distress, lost wages, and attorney's fees.

"Once a debt collector knows you have an attorney, they must communicate through your lawyer—giving you immediate relief from harassing calls."

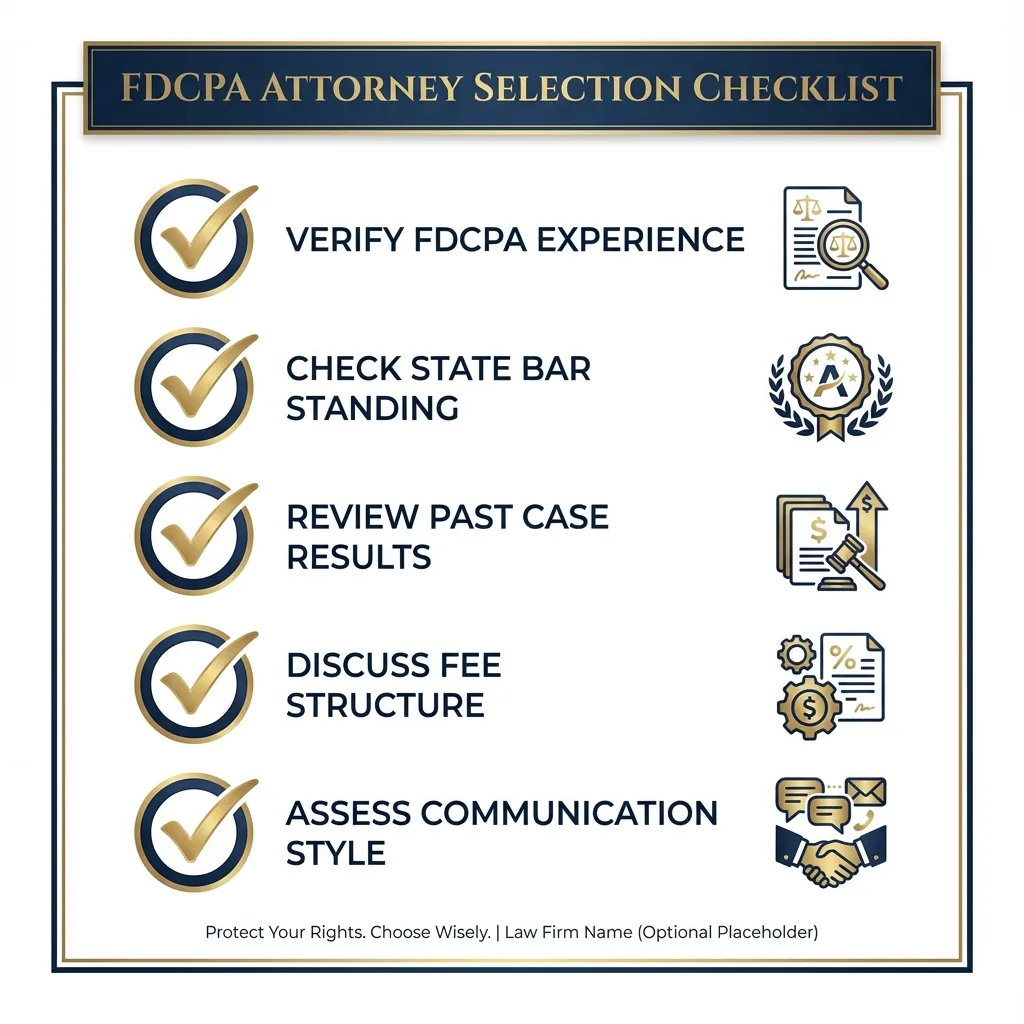

5 Essential Qualifications to Look For

1. Specific FDCPA Experience

Consumer law is a specialized field. You want an attorney who has handled dozens or hundreds of FDCPA cases—not someone who dabbles in it occasionally. Ask specifically: "How many FDCPA cases have you litigated?"

2. Verified State Bar Standing

Before hiring anyone, verify their license through your state bar association. This confirms they're in good standing and haven't faced disciplinary action.

3. Proven Track Record

Ask about their case results. A good FDCPA attorney should be able to share examples of settlements and verdicts they've achieved for clients in similar situations.

4. Clear Fee Structure

Most FDCPA attorneys work on contingency—meaning you pay nothing upfront and they only get paid if you win. The FDCPA also allows winning plaintiffs to recover attorney's fees from the defendant.

5. Strong Communication

Your attorney should be responsive and keep you informed. During your consultation, notice how well they listen and explain things in plain language.

Questions to Ask During Your Consultation

A free consultation is your chance to evaluate the attorney. Here are the essential questions:

| Question | What You're Looking For |

|---|---|

| "How many FDCPA cases have you handled?" | At least 50+ cases, ideally 100+ |

| "What's your strategy for my case?" | Clear, specific plan tailored to your situation |

| "How do your fees work?" | Contingency with no upfront costs |

| "Can you share similar case results?" | Specific examples with dollar amounts |

| "How will we communicate?" | Clear expectations for response times |

🚩 Red Flags to Avoid

Not every attorney advertising FDCPA services is equally qualified. Watch out for these warning signs:

Ready to Take Action?

If debt collectors are violating your rights, don't wait. The FDCPA has a one-year statute of limitations, so time is critical.