A credit score is more than just a three-digit number; it is a financial passport that determines your ability to rent an apartment, buy a car, or purchase a home. Ranging from 300 to 850, this score is a statistical prediction of your credit behavior, specifically how likely you are to pay back a loan on time.

Key Definitions

- Credit Score

- A numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual.

- FICO Score

- The most widely used credit score model, created by the Fair Isaac Corporation. It is used by 90% of top lenders.

- VantageScore

- A credit scoring model developed jointly by the three major credit bureaus (Equifax, Experian, and TransUnion) as an alternative to FICO.

What Makes Up Your Credit Score?

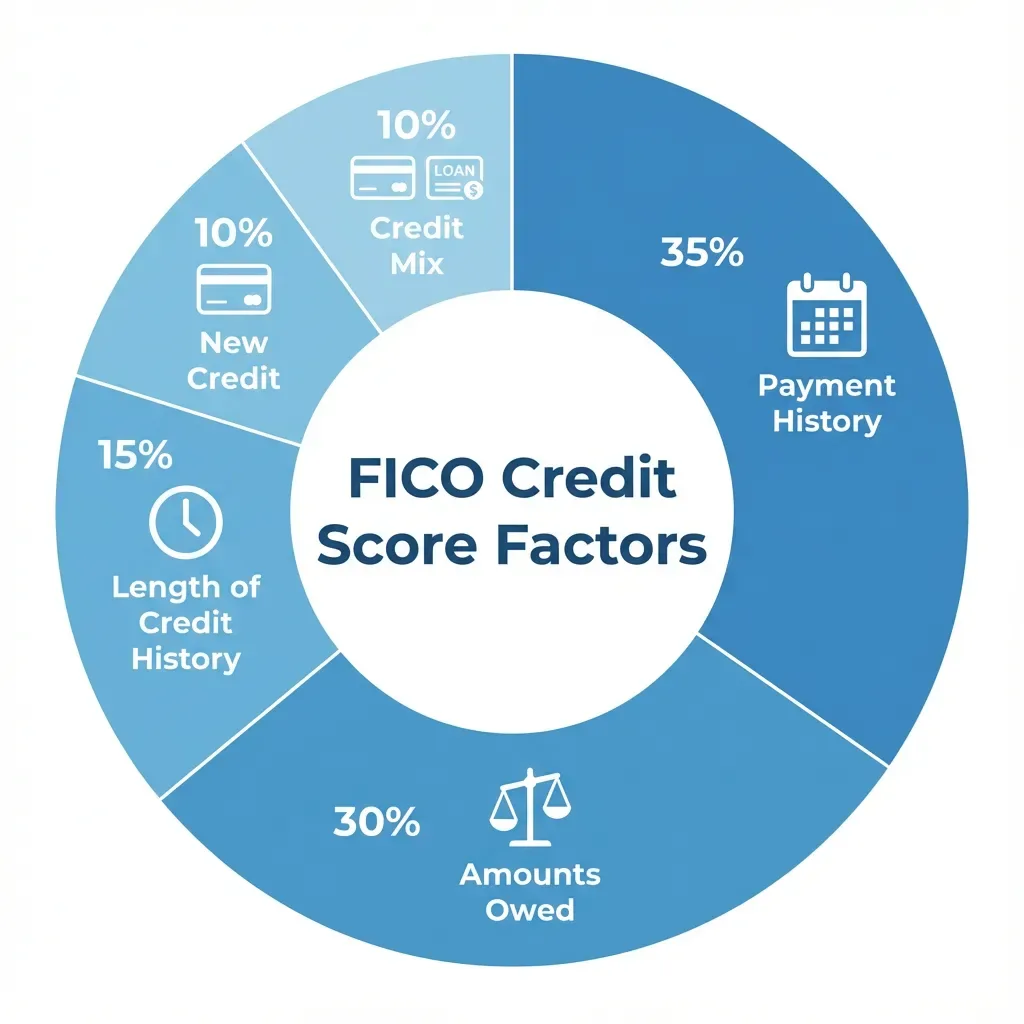

Your FICO score is calculated based on five specific categories of data contained in your credit reports. Understanding these factors is crucial for improving your score.

| Factor | Weight | Description |

|---|---|---|

| Payment History | 35% | Your track record of paying bills on time. Late payments can severely damage this component. |

| Amounts Owed (Utilization) | 30% | The ratio of your credit card balances to your credit limits. Lower is better. |

| Length of Credit History | 15% | The age of your oldest account, newest account, and average age of all accounts. |

| Credit Mix | 10% | The variety of credit accounts you have, such as credit cards, retail accounts, installment loans, and mortgages. |

| New Credit | 10% | Frequency of credit inquiries and new account openings. |

Credit Score Ranges

Lenders use these ranges to determine your risk level. A higher score generally results in lower interest rates and better loan terms.

| Score Range | Rating | Impact on Borrowing |

|---|---|---|

| 800 - 850 | Exceptional | Best interest rates and easiest approval. |

| 740 - 799 | Very Good | Better than average rates from lenders. |

| 670 - 739 | Good | Acceptable to most lenders, standard rates. |

| 580 - 669 | Fair | May be approved but with higher interest rates. |

| 300 - 579 | Poor | Rejected by many lenders; requires secured cards or deposits. |

Actionable Steps to Improve Your Score

Improving your credit score is a marathon, not a sprint. Here are concrete steps you can take immediately:

- Check Your Report for Errors: Request a free copy of your credit report from AnnualCreditReport.com and dispute any inaccuracies.

- Pay Down High Balances: Aim to get your credit utilization below 30% on all cards.

- Set Up Autopay: Ensure you never miss a payment by automating the minimum due.

- Don't Close Old Cards: Keep your oldest accounts open to maintain a longer credit history.

- Limit New Applications: Only apply for credit when you absolutely need it to avoid hard inquiries.

"Many consumers don't realize that checking their own credit score is a 'soft inquiry' and does not hurt their credit. Regular monitoring is the first line of defense against identity theft and errors."

Jeffrey S. Hyslip, Consumer Finance Attorney