Constant calls before sunrise. Voicemails laced with threats. Collectors contacting your family, your boss, your neighbors. If you're dealing with aggressive debt collectors, you don't have to sit there and take it. Federal law gives you real tools to stop debt collection harassment — and real consequences for collectors who refuse to follow the rules.

This guide walks you through the exact steps to make it stop, from documenting what's happening to filing formal complaints to knowing when it's time to call an attorney.

In This Guide

What Counts as Debt Collection Harassment?

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from using abusive, unfair, or deceptive tactics to collect a debt. If a collector is doing any of the following, they're likely breaking the law:

- Calling you before 8 a.m. or after 9 p.m.

- Calling repeatedly with the intent to annoy or harass you

- Threatening violence or physical harm

- Using obscene or profane language

- Threatening arrest, jail time, or legal action they have no authority to take

- Misrepresenting how much you owe

- Contacting you at work after you've told them to stop

- Telling your family members, friends, or coworkers about your debt

Harassment from a debt collector isn't just stressful — it can affect your sleep, your job, and your mental health. The emotional toll is real, and the law recognizes that. If what you're experiencing matches any of the behaviors above, you have the right to take action.

Step 1: Document Every Interaction

Before you do anything else, start keeping a detailed record of every contact from the collector. This documentation becomes your evidence if you decide to file a complaint or pursue legal action.

For every call, text, voicemail, or letter, write down the date and time of the contact, the name of the person who called, the agency they represent, and exactly what was said. Save voicemails — don't delete them. Screenshot text messages. Keep every piece of written correspondence, including envelopes.

A simple spreadsheet or notebook works fine, as long as you're consistent. If you want a more structured approach, our guide to documenting debt collector violations covers exactly what to track and how to organize it.

Step 2: Send a Cease and Desist Letter

Under the FDCPA, you have the right to tell a debt collector to stop contacting you — in writing. Once the collector receives your cease and desist letter, they must stop all communication with you except to confirm they'll stop or to notify you of a specific legal action, like filing a lawsuit.

This is the single most immediate step you can take to stop the calls. The letter doesn't erase the debt, but it puts a legal wall between you and the harassment. Make sure you send it via certified mail with return receipt requested so you have proof it was delivered.

What to Say If a Collector Calls You at Work

You don't need a lawyer or a letter to stop workplace calls. The next time a collector calls you at work, say this:

"My employer does not allow personal calls. Do not call me here again."

That's it. Under the FDCPA, once you tell a collector that your employer prohibits personal calls, they must stop contacting you at work immediately. If they call even once more after that, it's a federal violation — and potential grounds for a lawsuit. Write down the date, time, and the name of the person you spoke with so you have a record.

We have a free cease and desist letter template you can download and customize.

Step 3: File Formal Complaints

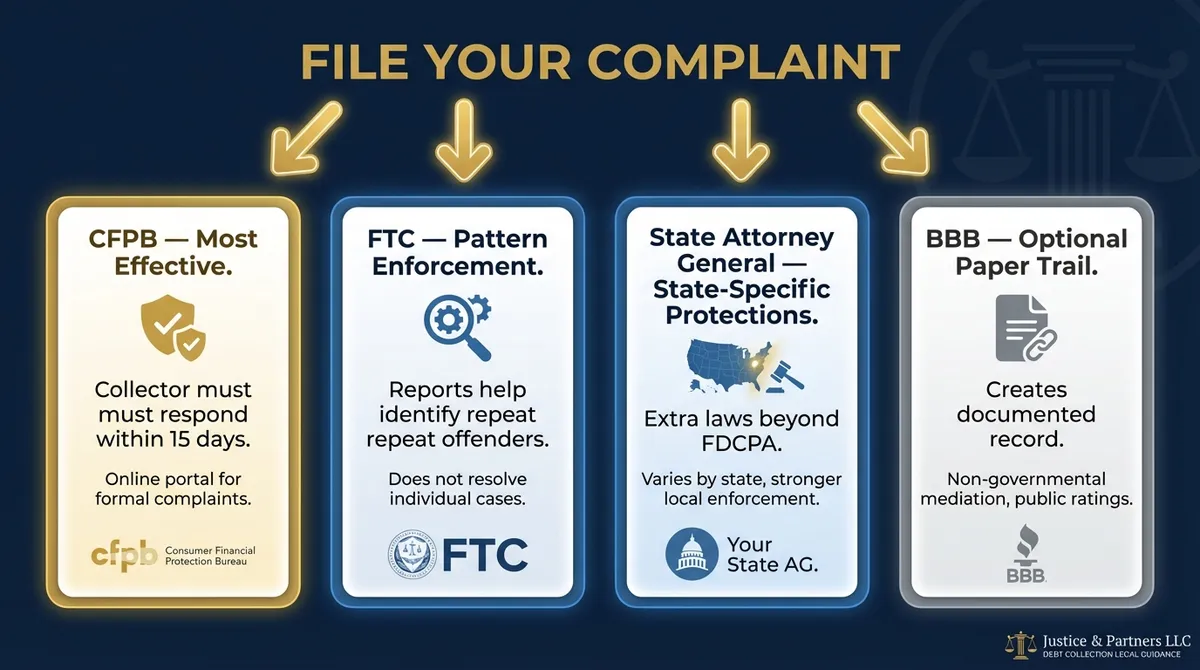

If the harassment continues — or if you want to create an official record of the collector's behavior — filing formal complaints is your next move. These complaints put real pressure on debt collectors and create a paper trail that strengthens any future legal claim.

Consumer Financial Protection Bureau (CFPB)

The CFPB is the most effective place to file. Go to consumerfinance.gov/complaint and select "Debt collection" as the product. You'll need to provide the name of the collection agency, what happened, and what resolution you're seeking. Include dates, call logs, and any supporting documentation you've gathered.

Once you file, the collector is required to respond to the CFPB within 15 days. The CFPB publishes complaint data publicly, which creates real accountability.

Federal Trade Commission (FTC)

Report the collector at ReportFraud.ftc.gov. The FTC doesn't resolve individual complaints, but it uses reports to identify patterns of abuse and take enforcement action against repeat offenders. Your report contributes to the bigger picture.

Your State Attorney General

Every state has a consumer protection division within the Attorney General's office. Search "[your state] attorney general consumer complaint" to find the right office and filing instructions. Some states have additional consumer protection laws that go beyond the FDCPA, so a state-level complaint can trigger protections specific to where you live.

Better Business Bureau (Optional)

Filing a BBB complaint isn't a legal remedy, but it creates another documented record of the collector's behavior and can sometimes prompt a response from the company. It's a low-effort step that adds to your paper trail.

Step 4: Know When to Contact an FDCPA Attorney

The steps above are things you can do on your own. But there are situations where you need a lawyer — and under the FDCPA, hiring one may not cost you anything out of pocket.

Contact an attorney if the collector continues calling after receiving your cease and desist letter, threatens you with arrest or criminal charges, sues you on a debt that's past the statute of limitations, contacts your family or coworkers about your debt, or reports false information to the credit bureaus.

FDCPA cases are typically handled on contingency, which means the attorney only gets paid if you win — and the collector is usually the one who pays the attorney's fees, not you.

If you're unsure whether your situation rises to the level of a legal case, our page on when to hire an FDCPA attorney can help you decide.

What Damages Can You Recover?

The FDCPA doesn't just tell collectors to stop — it makes them pay. If a debt collector violated your rights, you may be entitled to:

- Statutory damages of up to $1,000 per lawsuit, regardless of whether you suffered financial harm

- Actual damages for emotional distress, lost wages, or other harm caused by the harassment

- Attorney's fees and court costs, paid by the collector — not you

These aren't theoretical numbers. Hyslip Legal has recovered over $50 million for consumers just like you. The FDCPA was designed to have teeth, and we know how to use them.

Frequently Asked Questions

Can a debt collector keep calling after I send a cease and desist?

No. Once a debt collector receives your written cease and desist letter, they must stop contacting you. The only exceptions are to confirm they will stop or to inform you of a specific legal action. If they keep calling after receiving the letter, each additional contact is a separate FDCPA violation.

How long does a CFPB complaint take to resolve?

The debt collector has 15 days to respond to a CFPB complaint, though they can request an extension up to 60 days in some cases. Most consumers receive a response within 15 to 30 days. The CFPB will notify you when the company responds and give you the opportunity to provide feedback.

Will filing a complaint stop the debt collector?

Filing complaints with the CFPB or FTC creates accountability and a formal record, but it doesn't guarantee the calls will stop immediately. A cease and desist letter is the most direct way to legally require a collector to stop contacting you. Complaints work best as part of a broader strategy — especially when combined with a cease and desist and, if needed, legal action.

Can I sue a debt collector for harassment?

Yes. The FDCPA gives you the right to file a lawsuit against any debt collector that violates the law. You can recover up to $1,000 in statutory damages per case, plus actual damages and attorney's fees. You have one year from the date of the violation to file suit, so don't wait too long.

Does stopping a debt collector mean I don't owe the debt?

No. A cease and desist letter stops the collector from contacting you, but it doesn't eliminate the underlying debt. The collector can still pursue other remedies, such as filing a lawsuit. If you're concerned about the debt itself, consider speaking with an attorney about your options — including whether the debt is valid or past the statute of limitations.

What if the debt collector is calling about someone else's debt?

Debt collectors sometimes contact the wrong person due to errors in their records or skip-tracing databases. If a collector is pursuing you for a debt that isn't yours, you have the right to dispute the debt in writing within 30 days of their initial contact. The collector must stop collection activity until they verify the debt. If they continue, they're violating the FDCPA.

This information is for educational purposes only and does not constitute legal advice. Every situation is unique. Contact Hyslip Legal for a free consultation to discuss your specific circumstances.